Why the Fed’s Rate Pause Matters for Homebuyers in 2026 — And Why You Should Act Now

After a series of interest rate moves over the past year, the Federal Reserve has decided to hold its benchmark interest rate steady. At its January 28, 2026 meeting, the Federal Open Market Committee (FOMC) chose to keep the benchmark rate between 3.50% and 3.75% after three cuts late last year, citing solid economic growth and a stable job market. This pause comes amid persistent inflation above the Fed’s 2% target, and a cautious approach by policymakers who want to see clearer signs of inflation receding before cutting rates further.

Understanding how this decision may affect housing can help you make smarter decisions as a buyer — especially right now, when conditions are tilting in your favor.

1. What the Fed Does — And What It Doesn’t Directly Control

When the Federal Reserve adjusts its target interest rate, that primarily influences short-term borrowing costs, which banks use to lend to each other. It does not directly set mortgage interest rates. Instead, mortgage rates are more closely tied to long-term Treasury yields and the pricing of mortgage-backed securities.

Why does this matter?

Even if the Fed pauses, mortgage rates can still move independently — based on bond market movements, inflation expectations, and broader economic sentiment.

2. Mortgage Rates Are Still Low Compared With Recent History

Despite the Fed’s cautious stance, mortgage rates have come down from recent peaks. According to market data:

The average 30-year fixed mortgage rate has dipped into the low 6% range, a multi-year low.

This is significantly below rates above 7% seen as recently as mid-2025.

While rates aren’t back in the low-4% territory of the pre-pandemic era, this improvement still represents meaningful savings for buyers. For example, a drop from ~7% to ~6.2% on a typical mortgage can lower monthly payments and increase purchasing power — potentially thousands in savings over time.

3. The Housing Market Is Still a Buyer’s Market

Here’s the key context every buyer should know:

Inventory is rising — more homes are available now than a year ago.

With fewer sellers motivated by interest rate incentives (many homeowners locked into sub-4% mortgages), existing supply is still constrained, increasing buyer leverage.

Houses are not flying off the market nearly as fast as they did during the 2020–2022 boom, giving buyers more time to compare properties and negotiate terms.

All of this adds up to a buyer’s market — where demand is more balanced with supply, and buyers can extract concessions, request repairs, or negotiate pricing. Waiting for some hypothetical “perfect time” could mean missing out on this window of negotiation strength.

4. Why the Fed May Cut Rates Later in 2026 — But Don’t Wait

Although the Fed paused in January 2026, most policymakers and economists still expect a couple of rate cuts later this year — possibly around mid-year — if inflation continues to decline.

Here’s the crucial part: even if the Fed cuts the federal funds rate, mortgage rates won’t immediately fall in lockstep. They are influenced by global bond markets, inflation expectations, and the broader credit environment.

This means:

Mortgage rates could drift lower over time — but not necessarily immediately after a Fed cut

They also could stay elevated or stabilize, especially if inflation remains stubborn or if long-term yields rise

In other words: timing the market perfectly is unpredictable. Acting on good conditions now is smarter than waiting for perfect conditions later.

5. What This Means for You as a Buyer

You have more negotiating leverage today

With inventory not as tight as during the frenzied pandemic market, you can often:

Ask for seller credits

Request repairs

Negotiate price reductions

Compete without overbidding

Mortgage costs are lower than they were a year ago

Even if not as low as historically, low-to-mid-6% rates still make buying more affordable than in 2025 peaks.

Waiting could cost you

If rates stall or reverse, or if inventory tightens again, you could end up paying more later — even if future cuts are anticipated.

6. Final Takeaway: The Time to Buy Is Now

We are currently in a buyer’s market, meaning conditions favor those ready and able to act. Low-to-moderate mortgage rates, increased inventory, and a pause in Fed tightening give buyers unique leverage to negotiate better terms and find homes that fit their needs.

The Fed’s rate pause in early 2026 doesn’t signal a market freeze — it signals stability, and often, that’s exactly what motivated buyers need to confidently make a move. Don’t let uncertainty delay your homeownership goals when the current conditions provide a strategic advantage.

Stay Informed, Stay Ready

Whether you’re a first-time buyer, relocating, or upgrading, this market presents opportunities that won’t last forever. Reach out for a personalized strategy based on your situation and goals — we’re here to help you navigate every step of your homebuying journey.

HOME INSPECTIONS

BUYER SIDE / SELLER SIDE

A home inspection is a professional, objective assessment of a property's physical structure and major systems. It's a vital step in the home buying process, helping to uncover potential issues before closing, so buyers can make informed decisions.

As the buyer, you have the right to choose your own home inspection company. You're not required to use one recommended by the agent or seller—feel free to select a licensed inspector you trust to thoroughly evaluate the property and protect your interests.

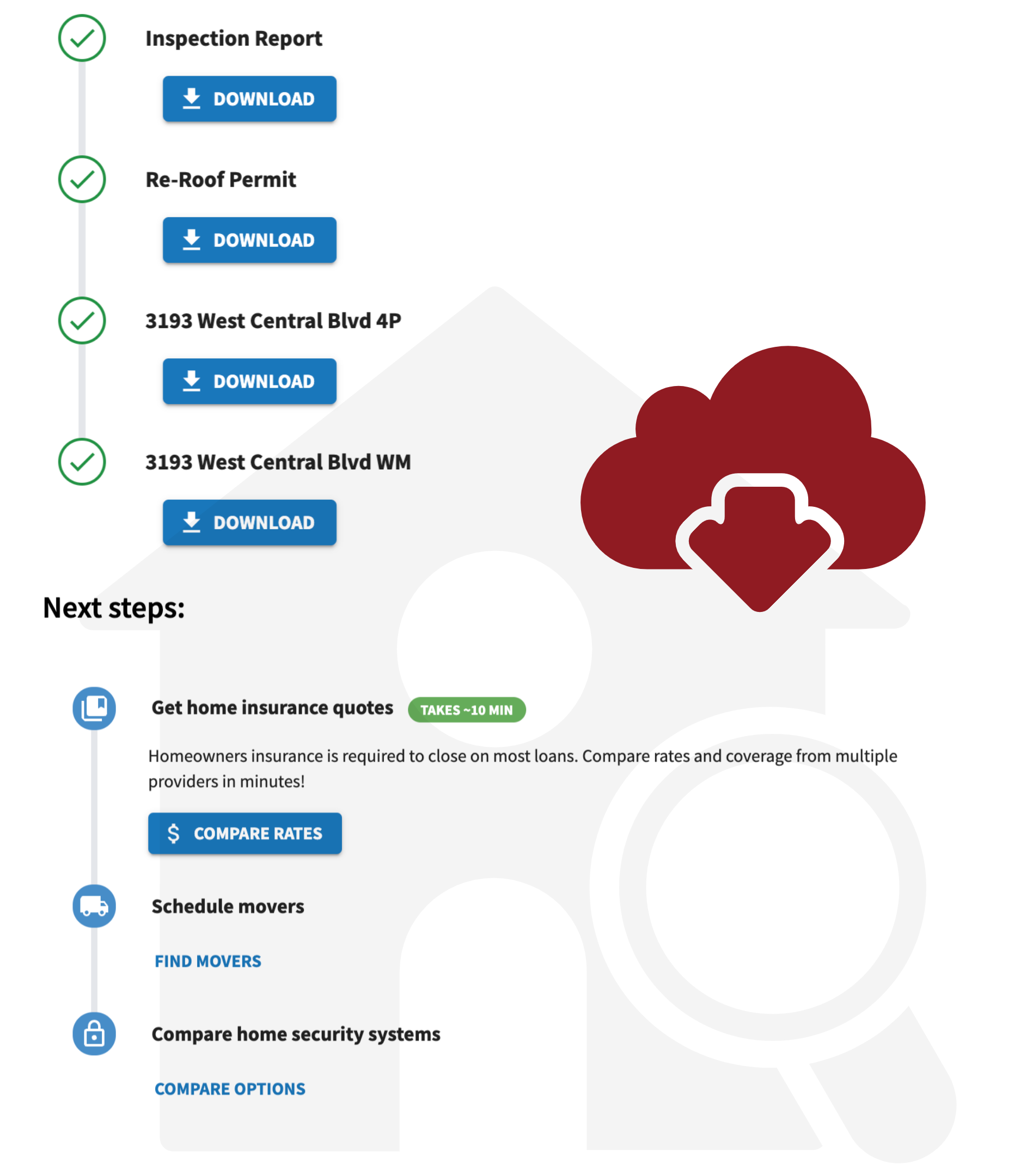

Once the inspection and payment is made, you'll receive access to your personalized buyer portal, where you can view your inspection report, photos, and any recommended next steps

INSPECTION “ADD-ONs”

A 4-point inspection is often required by insurance companies in Florida, especially for homes over 20 years old. It focuses specifically on the roof, electrical, plumbing, and HVAC systems to determine insurability. While it's not part of a standard home inspection, it can usually be added on during the same visit and is essential for securing homeowners insurance.

For a cash buyer, a 4-point inspection is not required, since there's no lender or insurer mandating it—unless the buyer still plans to get homeowners insurance.

A wind mitigation inspection evaluates how well a home can withstand strong winds and hurricanes—a key factor in Florida insurance costs. It looks at roof shape, coverings, attachments, and protection for openings like windows and doors. This report can often qualify buyers for valuable insurance discounts.

A well inspection checks the condition and safety of a property's private well system, including the pump, pressure tank, and water quality. It ensures the water is safe for use and that the system is functioning properly—an important step for homes not connected to municipal water.

A septic tank inspection evaluates the condition and functionality of a home's private wastewater system. It includes checking the tank, drain field, and related components to ensure proper operation and identify any signs of leaks, backups, or needed maintenance—crucial for homes not connected to public sewer lines.

A water test analyzes the quality and safety of a home's water supply, checking for contaminants like bacteria, lead, nitrates, and other pollutants. This is especially important for properties with a well, ensuring the water is safe for drinking, cooking, and daily use.

A termite inspection checks for signs of active or past termite activity, as well as other wood-destroying organisms that can damage a home's structure. It’s a vital step in protecting your investment, especially in Florida’s warm, humid climate where termites are common.

Real estate agents play a crucial role in recommending home inspections and helping clients understand the results. They guide buyers and sellers through the implications of the findings, advise on necessary repairs, and help protect both the property's value and the client's interests.

For sellers, a pre-listing home inspection gives sellers valuable insight into their property's condition. By identifying and addressing issues early, sellers can increase market value, build buyer confidence, and help ensure a smoother, faster sale.

Sample section of inspection results:

Once the home inspection report is in hand, it can feel overwhelming for buyers—especially first-timers. That’s where a knowledgeable real estate agent steps in. As your advocate, a Realtor doesn’t just review the report; they help you interpret it strategically.

Not every item on an inspection report is worth negotiating over. Your agent will help you identify which issues are safety concerns, code violations, or major system failures—and which ones are cosmetic or expected for the home’s age. From there, your agent will work with you to draft a clear, reasonable repair request or ask for seller concessions if appropriate.

This negotiation process requires a balance of firmness and finesse. An experienced agent knows how to present your request professionally, keeping the deal moving forward while protecting your best interests.

PRE-LISTING INSPECTION

Sellers benefit from home inspections by gaining transparency about their property's condition. Pre-inspection enables sellers to address issues ahead of time, enhancing market value and speeding up the sale.

Top 10 Things Sellers Should do to Prepare for an Inspection:

Change the AC filter and clean vents. A dirty filter or dusty vents suggests poor maintenance. A fresh filter and clean ducts show the HVAC system is being properly cared for.

Check for plumbing leaks. Inspect under sinks, around toilets, and behind appliances for any signs of leaks or water damage. Fix drips, loos connections, and water stains.

Test all smoke and carbon monoxide detectors. Replace batteries and ensure all detectors are property installed and working.

4. Service the HVAC system. Have the AC and heating system serviced by a licensed technician if it hasn’t been done in the past year. Leave documentation of the service for the inspector.

5. Ensure all lights, outlets and fixtures work. Replace any burnt-out bulbs, and test each outlet. This avoids the assumption that electrical work may faulty.

6. Clean gutters and dowspouts. Clear out debris and ensure water is draining away from the foundation properly.

7. Repair minor wall and ceiling cracks or nail pops. There are often cosmetic but can be misinterpreted as foundation or structural issues.

8. Check doors and windows for proper operation. Make sure they open, close and lock properly. Fix any sticking, squeaking, or loose hardware.

9. Seal gaps around windows for proper operation. Prevent drafts, moisture intrusion and pest access. Use caulking or weaither stripping where needed.

10. Label the electrical panel and ensure clear access. Inspectors need to see the panel clearly labeled and unobstructed. Replace any missing covers or breakers if needed.

“THANK YOU!”

Florida’s Tourism Economy Surged in 2024, Creating Jobs, Revenue, and Long-Term Real Estate Demand

According to the latest study by VISIT FLORIDA, the Sunshine State’s tourism industry delivered a historic $133.6 billion in economic impact in 2024. That massive influx of visitor dollars helped support approximately 1.8 million jobs statewide and generated $79.9 billion in wages — a substantial portion of which contributed directly to households across Florida.

Out-of-state travelers spent an estimated $134.9 billion in 2024, marking a 3.0 percent increase over 2023. Of that total, U.S. visitors contributed about $120.1 billion, while international tourists added roughly $14.8 billion. For every dollar spent by a visitor, nearly 99 cents remained circulating within Florida’s economy — with as much as 59 cents per dollar going toward wages. That retention rate is up from prior years, illustrating the strengthening multiplier effect of tourism on the local economy.

On top of supporting employment and wages, tourism--driven economic activity delivered $33.6 billion in combined federal, state and local tax revenue. According to the report, this tax haul effectively reduced the average tax burden for Florida’s more than nine million households by nearly $2,000 per year.

Those figures reflect more than just tourism — they reveal the engine behind many of Florida’s broader socioeconomic strengths: robust employment, strong wage growth, stable public financing, and a business-friendly climate that attracts more people who want to live, work, and invest here.

Why This Tourism Surge Matters for Real Estate

As a seasoned Florida real estate agent (and attorney), it's clear that tourism-driven economic growth reverberates through the housing market in several meaningful ways:

Population growth and migration: The strong job market and stable economy make Florida increasingly attractive to newcomers — retirees, remote workers, investors, out-of-state buyers — all fueling demand for housing.

Investor confidence: Consistent tourist spending and economic inflows suggest long-term stability for both residential and rental markets. Investors are more likely to consider purchasing properties in areas with a resilient economy and diversified revenue streams.

Demand for second homes and vacation rentals: With tourism booming, areas popular with travelers (coastal regions, metropolitan centers, near attractions) become appealing not only to full-time residents but also to short- and mid-term rental investors.

Public infrastructure & services: Strong tax revenue helps fund infrastructure, public services, and amenities — factors that make neighborhoods more desirable and support higher property values.

In other words: the tourism windfall indirectly elevates the real estate market by strengthening the underlying economic foundations across the state.

What Florida Real Estate Could Look Like in 2026

Looking ahead toward 2026, the economic and real estate outlook in Florida remains optimistic, especially given current investment trends and demographic shifts. Some of the key signals pointing to growth include:

Moderate but steady home-value appreciation: According to market-wide analyses, real estate appreciation in Florida is projected to continue at a modest rate (roughly 3–5 percent annually) through 2026 — a manageable growth that avoids bubble-like volatility while still offering value appreciation.

Sustained demand from in-migration and retirees: As more out-of-state residents and retirees relocate to Florida — attracted by favorable tax laws, climate, and quality of life — demand for housing and rental properties is expected to remain strong.

Balanced market conditions — more inventory, but still selective demand: Recent market data suggest inventory is gradually improving, while demand remains strong. This could produce a more balanced market where buyers have choices but sellers can still achieve healthy sales prices.

Opportunities for investors and developers: With high demand, shifting demographics, and economic strength driven by tourism and migration, there’s potential for well-timed purchases — especially in emerging or undervalued markets.

For a real estate professional with legal and negotiation expertise, 2026 may present one of the better windows in recent years to guide both end-buyers and investors toward long-term gains.

Let us know how we can help with your Florida real estate needs:

Refinancing: Waiting for Lower Rates Could Cost More Than It Saves

The idea of waiting for the “perfect” interest rate has become a common talking point among buyers watching the market. But in reality, waiting often comes with a cost. Renters continue to pay every month without building equity, while homeowners begin creating value from day one — even if rates aren’t ideal.

A trusted lender recently explained how refinancing works once a home is purchased. For FHA loans, homeowners can typically refinance after six monthly payments. Conventional loans often allow even more flexibility, as long as the refinance makes financial sense. This means buyers can purchase now and refinance later to potentially lower their monthly payment, without losing the equity they’ve already built.

The challenge of waiting is that when rates eventually fall, buyer demand will surge. Increased competition can drive up home prices, create bidding wars, and require larger down payments. Those who wait risk paying more overall, even if rates are lower.

Strategically, buying now and refinancing later allows homeowners to start building wealth immediately, while positioning themselves to benefit from future rate drops. With rates hovering around 6.5–7% and inventory gradually improving, buyers have an opportunity to secure homes now without facing the intense competition likely to return once rates decrease.

Rent vs. Buy (6 Months)

Over just six months, a renter paying $2,400 per month spends $14,400 with nothing to show for it. A homeowner who buys a $400,000 home at 7% interest pays roughly $2,800 per month — about $16,800 total over that same period.

The difference? That homeowner starts paying down principal immediately, gaining ownership from day one.

Equity Built vs. Rent Paid (1 Year)

In one year, the renter pays about $28,800 and builds zero equity.

The homeowner pays about $33,600, but roughly $6,000 of that goes straight toward their home — not to a landlord. If the home appreciates just 5%, that $400,000 property could be worth $420,000 by year’s end, adding another $20,000 in equity. That’s a $26,000+ swing in net worth over one year.

Effect of Rate Drop + Price Surge

If mortgage rates drop from 7% to 5%, prices are likely to surge as buyer demand floods back.

A home worth $400,000 today could quickly rise to $460,000 or more.

Yes, a lower rate may save around $400/month, but the higher home price and down payment could offset much of that advantage. In many cases, waiting ends up costing more overall — and missing out on thousands in equity growth.

The Takeaway

Renters are paying 100% interest — every payment disappears. Buyers, even with today’s rates, are building wealth with every mortgage payment. The best move? Buy smart now, refinance later, and own the appreciating asset instead of chasing it.

Mortgage Market Poised for Growth: How 2026 Could Mark a Turning Point for Housing

The Mortgage Bankers Association (MBA) recently released its forecast for the U.S. mortgage market, calling for modest growth in single-family loan activity over the next year. According to MBA’s projections, total originations will climb to around $2.2 trillion in 2026, up from about $2.0 trillion expected in 2025.

Purchase-loan volume is projected to rise by roughly 7.7 % to approximately $1.46 trillion, while refinance volumes are forecast to expand by about 9.2 % to $737 billion. On a loan-count basis, the group anticipates total originations climbing to about 5.8 million units in 2026, up from an estimated 5.4 million in 2025.

Presenting the outlook at MBA’s Annual Convention, Chief Economist Mike Fratantoni and Deputy Chief Economist Joel Kan, along with Vice President of Industry Analysis Marina Walsh, laid out the reasoning behind the forecast.

Fratantoni cautioned that U.S. economic growth is likely to remain below trend, weighed down by global headwinds and tariff-related uncertainty. He noted the labor market is softening, projecting the unemployment rate to rise from around 4.3% to about 4.7% during 2026. Inflation, he added, will continue to be sticky as import tariffs gradually feed through to higher consumer prices.

From a housing-market standpoint, Fratantoni explained that declining mortgage rates—though not dramatically lower—combined with a gradual increase in housing supply are improving affordability. He said that while rates are unlikely to tumble to sub-5% levels, a more abundant inventory will exert downward pressure on home prices, potentially causing national price declines over the coming quarters.

Kan added that housing conditions are far from uniform: areas such as Florida, Colorado and Arizona—with growing inventories—are already seeing year-over-year price drop-offs, whereas states in the Northeast and Midwest, such as New York, Connecticut, Illinois and New Jersey, continue to experience price gains driven by tight supply.

Walsh turned attention to the mortgage industry context, noting that Q2 2025 production profitability reached its highest level since 2021—ending a long run of losses. While origination costs remain elevated and closing-rates are declining, she observed that lenders are aggressively seeking efficiency gains through technology adoption, process refinement, and consolidation. She also pointed out the servicing side of the business is performing strongly and that the roughly $36 trillion in accumulated homeowner equity provides a major buffer against distress even as layoffs or affordability pressures mount.

On the commercial front, the MBA also published updated forecasts for real-estate lending. The volume of commercial real–estate and multifamily originations is projected to increase by about 16% in 2026, with total volumes approaching $700 billion for the sector.

Other Insights:

The rise in purchase activity reflects a thawing of the “lock-in” effect: many homeowners are sitting on ultra-low rate mortgages and reluctant to trade them, but with inventory slowly rising and rate volatility growing, more sellers are entering the market.

While refinance opportunities remain limited in the near term, rate dips below ~6% are still expected to trigger temporary surges in refi activity, especially among adjustable-rate borrowers and those with shorter-duration mortgages.

Location really matters: “Sun belt” states continue to be hotbeds for bidding wars, while supply-rich areas are seeing price moderation. For agents, this means hyper-local market intelligence is more valuable than ever.

Cost burdens beyond mortgage rates — including homeowners insurance, property taxes and HOA fees — are increasingly shaping affordability dynamics. The accumulation of homeowner equity offers a cushion, but also masks emerging risk in certain segments of the market.

For new-home builders and lenders, the pressure to cut costs is mounting. Many are evaluating ways to streamline operations, adopt automation and refinance back-office systems as margins get squeezed.

Wondering what these trends mean for your goals?

Let’s talk about your plans and explore what’s possible in today’s market!

August Housing Market Snapshot

Nationwide home sales were essentially flat in August, dipping by just 0.2% compared with July. The median U.S. sales price rose 2% year-over-year, reaching $422,600. On average, homes spent 31 days on the market, slightly longer than earlier this summer.

Regional performance:

Midwest: Sales increased 2.1% month-to-month and 3.2% compared to last year. Median price: $330,500 (+4.5%).

West: Sales edged up 1.4% from July but fell 1.4% annually. Median price: $624,300 (+0.6%).

South: Transactions dropped 1.1% from July but rose 3.4% from last year. Median price: $364,100 (+0.4%).

Northeast: Sales slipped 4% month-to-month and 2% annually. Median price: $534,200 (+6.2%).

Inventory and supply:

About 1.53 million homes were on the market, 1.3% fewer than July but 11.7% higher than a year ago.

Supply held steady at 4.6 months, up from 4.2 months last year.

Property type trends:

Single-family homes: 3.63 million sales pace (-0.3% vs. July, +2.5% vs. last year). Median price: $427,800 (+1.9%).

Condos/co-ops: 370,000 sales pace (flat month-to-month, -5.1% vs. last year). Median price: $366,800 (+0.6%).

Buyer activity and conditions:

First-time buyers represented 28% of sales, unchanged from July.

Cash deals accounted for 28% of closings, down from 31% last month.

Investors and vacation-home buyers made up 21% of sales.

Distressed sales remained low at 2%.

Financing:

The average 30-year fixed mortgage rate was 6.59% in August, down from 6.72% in July but higher than 6.50% one year ago (Freddie Mac).

Key takeaway:

While elevated mortgage rates and abundant supply continue to challenge momentum, the Midwest’s affordability stands out as a bright spot. Pricing power remains strongest in higher-end markets, while entry-level homes face tighter supply.

Prices Down, Inventory up: What June’s Market Stats Mean for Buyers

The numbers are in for June 2025 — and they tell the story of a market that’s shifting in real time. Whether you’re a buyer hoping for a window of opportunity or a seller trying to time your move right, here’s what the latest data says.

Home Prices Are Slipping

Compared to June of last year, prices are down across the board.

Average sold price: ↓ 5.23%

Median sold price: ↓ 4.34%

Condos and townhomes: ↓ 13.31% (the hardest hit category)

This isn’t a crash — it’s a correction. Sellers are adjusting; buyers are gaining leverage.

Inventory Is Up — Way Up

There are nearly 29% more homes on the market than there were this time last year. That means buyers have more choices, less pressure, and more room to negotiate.

This is the kind of market where informed buyers can step in and find value — especially if they’re pre-approved and ready to move.

Homes Are Taking Longer to Sell

The average home in June took 68 days to sell, up from 56 a year ago — a 21% increase.

This tells us demand is still active, but it’s not frenzied. Buyers are taking their time. Sellers can’t just name a number and expect a full-price offer on day one anymore.

Price Cuts Are Back on the Table

The average home sold for 92.8% of its original asking price — down from 94.5%.

That 1.7% drop might not sound like much, but on a $400,000 listing, that’s a $6,800 gap. And that doesn’t include additional credits, repairs, or closing cost concessions.

If you’re selling, pricing smart from the start matters now more than ever.

Financing Breakdown

Here’s how deals got done in June:

Conventional loans: 6,044 homes

Cash sales: 4,627 homes

FHA loans: 3,032 homes

VA loans: 974 homes

Serious buyers across all categories are locking in homes.

What This Means for You

Buyers:

This is your window. Inventory is high, prices are softening, and sellers are negotiable. Get pre-approved, know your numbers, and let’s go shopping.

Sellers:

The market is still moving, but strategy matters now. Pricing too high? You’ll sit. Underestimate the shift? You’ll leave money on the table. Let’s make your sale competitive.

Need help making a move? I’m here to guide you — with real data and real strategy.

Let’s talk about your goals and build a plan that makes sense in today’s market.

Data source: Stellar MLS June 2025 Market Statistics, compiled by ShowingTime®.

Market data referenced in this post is based on June 2025 statistics provided by Stellar MLS, compiled by ShowingTime®. All information is deemed reliable but is not guaranteed. Readers should verify details independently before making real estate decisions.

Buying a Home for $5,000 in Florida? Here’s What you Need to Know

From TikTok to YouTube, the idea of buying a house for just a few thousand dollars has taken off — especially when people talk about homes with unpaid taxes or "liens." But can you really buy a home for $5,000? Let’s clear up the myths and share the real facts, especially for buyers in Florida.

Every so often, a headline or social media post makes it sound like homes can be bought for just a few thousand dollars if the owner is behind on property taxes. It’s an idea that catches attention fast — but is it true?

As a licensed Florida real estate professional, I want to clear up some common misunderstandings about tax-delinquent properties, tax liens, and how these situations really work. The short answer? Buying a home for $5,000 is extremely rare — and far more complicated than it seems.

What Happens When Property Taxes Go Unpaid?

When a homeowner in Florida doesn’t pay their property taxes, the county doesn’t just take the house and list it for sale. Instead, the county places a tax lien on the property — a legal claim for the unpaid amount. This doesn’t transfer ownership to the county or to a buyer.

To recover the unpaid taxes, Florida counties sell tax lien certificates at public auctions. These are mostly purchased by investors.

What’s a Tax Lien Certificate?

A tax lien certificate is not ownership of the home. It’s essentially an investment. The buyer of the certificate pays the homeowner’s tax bill and earns interest when the homeowner eventually pays it back.

If the taxes aren’t repaid within a certain period (usually two years), the certificate holder can apply for a tax deed sale, which is a separate and more serious process.

What’s a Tax Deed Sale?

A tax deed sale is a type of public auction where the property itself can be sold to satisfy the unpaid taxes. These are usually cash-only auctions and are attended by experienced investors.

But here’s the catch:

Opening bids usually start around the amount of taxes owed, which may be low — but…

Bidding often escalates quickly.

There’s no guarantee of clear title (i.e., the home may still have mortgages, liens, or legal issues).

Buyers typically cannot inspect the property inside before purchasing.

There may be code enforcement fines, title complications, or even squatters.

So, while a $5,000 price tag might be the minimum bid on a tax deed auction, the risks and unknowns involved are significant.

Why a $5,000 Home Isn’t Likely

The idea that someone can buy a regular home for $5,000 from a seller just because they’re behind on taxes doesn’t match how Florida’s tax system works. A tax lien is not the same as foreclosure, and even a tax deed sale doesn’t guarantee a buyer will walk away with a ready-to-live-in home or clean title.

If you’re working with financing — like an FHA, VA, or conventional loan — these types of auction properties are not eligible. Lenders require homes to meet strict condition standards and have insurable, clear titles.

A Better Path to Homeownership

For buyers hoping to get into a home affordably, there are real programs designed to help:

FHA loans allow for low down payments (as little as 3.5%).

Down payment assistance programs exist across Florida, especially for first-time buyers.

Some properties do hit the market well below average prices — and these are safer, more transparent opportunities that can be financed and inspected properly.

Working with a licensed real estate professional ensures you don’t waste time chasing misleading opportunities and instead focus on what’s actually possible — whether that’s buying a primary home, an investment property, or finding your first place with help from trusted lenders and local programs.

How to Build Great Credit and Avoid Hidden Pitfalls

Building good credit habits can open the door to homeownership.

There’s no quick fix for building an excellent credit score—it’s the result of months and years of consistent, responsible habits. Paying every bill on time is one of the single biggest factors in your score, so create systems that make it hard to miss due dates, like autopay or reminders.

Open and Maintain Bank Accounts

Start with a checking and savings account at a reputable bank or credit union. Keep them active and funded—regular deposits and withdrawals show stability. Growing your balances over time is another positive sign to lenders.

Put Accounts in Your own Name

If you’re young or starting out, establish a credit footprint by putting utilities, streaming services, or cell phone accounts in your own name. Even something as simple as internet service can demonstrate responsibility when those bills are consistently paid.

Improve Credit Authorization Ratio

Your utilization ratio—credit used versus total available credit—can be improved relatively quickly. Aim to keep balances under 30% of your total available limit. Paying down cards right before your statement closes can help.

Tip: If you have good payment history, you can also request a credit limit increase to help bring the ratio down, but only if you can resist the temptation to spend more.

Be Added as an Authorized User

If you have a family member or close relative with excellent credit, ask if they can add you as an authorized user on their credit card. You’ll get the benefit of their positive history—often years of on‑time payments and low utilization—showing up on your own report. This can help accelerate your credit building.

Build Responsibility With Credit Cards

If you can’t get a standard credit card, ask your bank about a secured card—it requires a cash deposit (often around $500) and is low risk for the lender. Use it lightly and pay it off every month.

Make at least your minimum payment, but ideally more. Paying only the minimum month after month signals financial strain. Showing you can handle a balance and pay it down consistently builds trust with issuers.

Why Closing Credit Cards Can Hurt Your Credit

Your credit score (in most cases, a FICO® Score) is made up of several weighted factors. Closing an account directly impacts at least two major components of your score and indirectly touches others:

Credit Utilization (≈30% of your score)

Utilization = Total revolving balances ÷ Total revolving limits

Example:

You have two cards with $5,000 limits each = $10,000 total available.

You carry a $3,000 balance.

Utilization = $3,000 ÷ $10,000 = 30% (good).

If you close one card:

Your available credit drops to $5,000.

Utilization = $3,000 ÷ $5,000 = 60% (high).

Result: Your score drops because you appear overextended.

Technical takeaway: Closing a card shrinks your denominator (total available credit) while your balances remain the same, instantly spiking utilization.

Length of Credit History (≈15% of your score)

This factor considers:

Average Age of Accounts (AAoA)

Age of your oldest account

Older accounts provide stability and trustworthiness in your credit profile.

If you close an older card:

Even though the closed account may remain on your report for 7–10 years, it no longer actively contributes to your AAoA.

Future new accounts will drag down your average age faster.

Credit Mix (≈10% of your score)

Lenders like to see a mix of revolving (credit cards) and installment (loans) accounts.

Closing a card reduces that diversity.

Technical takeaway: Fewer active revolving accounts can slightly lower your mix score, though this impact is smaller than utilization or age.

Potential Future Underwriting Issues

Some lenders look beyond your score and review your report manually.

Closing accounts with high limits reduces your available liquidity, making you look riskier.

A thin file (fewer active accounts) can raise red flags, even if your score is okay.

Monitor and Protect Your Credit

You can reduce the flood of pre‑approved credit offers (which often tempt overspending) by opting out. Visit OptOutPrescreen.com—the official site to remove your name from many prescreened credit and insurance lists. This doesn’t affect your score and can cut down on mail and solicitations.

What Do Credit Repair Companies Do?

Credit repair companies work on your behalf to challenge and correct errors or negative items on your credit report. They don’t perform magic, but they handle time‑consuming tasks and can sometimes speed up improvements.

Here’s what they typically do:

Dispute inaccurate items – They review your credit reports from the three major bureaus (Experian, Equifax, TransUnion) and formally dispute errors, like accounts that don’t belong to you, incorrect late payments, or duplicate records.

Negotiate with creditors – Some companies contact lenders or collection agencies directly to request debt verification, goodwill adjustments, or even settlements that could improve your report.

Monitor progress – They track the status of disputes and provide updates as negative items are removed or corrected.

Coach you on rebuilding – Some provide guidance on opening new accounts, using secured cards, or lowering utilization.

Important to know:

They can’t remove accurate, legitimate debt. If an item is valid, it stays—time and good habits are the only fix.

They charge fees. Some charge per item removed, others charge monthly service fees.

Do your research. Look for companies with strong reputations, clear contracts, and compliance with the Credit Repair Organizations Act (CROA). Avoid anyone promising a “quick fix” or guaranteeing specific score increases.

What Is a Community Land Trust (CLT) and How Does It Work?

For many Floridians, the dream of homeownership feels increasingly out of reach. Rising prices, bidding wars, and investor competition have made it difficult for working families, retirees, and first-time buyers to find affordable homes—especially in desirable areas like Orlando, Kissimmee, and the surrounding region. But one lesser-known solution is gaining ground: the Community Land Trust (CLT).

In this post, we’ll break down what CLTs are, how they work, who can qualify, and what the process typically looks like—so you can make an informed decision about whether this model is right for you.

What is a Community Land Trust?

A Community Land Trust is a nonprofit organization that owns and manages land on behalf of a community. Its mission is to provide permanently affordable housing by separating ownership of the land from ownership of the home. Homebuyers purchase the house at a below-market rate, while the CLT retains ownership of the land underneath it. The buyer signs a long-term ground lease (typically 99 years), which gives them exclusive use of the land while ensuring the home remains affordable for future buyers. This model helps communities combat displacement, preserve affordability over generations, and empower families to build equity—even if not at full market pace.

How Does it Work?

The CLT acquires land, often through donation, public funding, or community partnerships.

Homes are built or rehabbed on the land, and offered to qualified buyers at affordable prices—significantly below market rate.

Buyers purchase the home (not the land) and sign a renewable 99-year ground lease with the CLT.

The ground lease includes terms that:

Ensure owner occupancy

Restrict resale price to keep the home affordable

Require maintenance and property upkeep

When the homeowner sells, they receive a portion of the home’s appreciation—but the next buyer also benefits from affordability.

Is This Like a Mobile Home on Leased Land?

Not at all. While both situations involve leasing land, a Community Land Trust offers long-term legal protections, equity-building, and resale rights that you do not get in a typical mobile home park or leased-lot scenario.

Here’s the key difference:

CLT vs. Mobile Home on Leased Land

| Feature | Community Land Trust | Mobile Home on Leased Land |

|---|---|---|

| Land Ownership | CLT nonprofit owns land permanently for community benefit | Private owner or corporation owns land for profit |

| Lease Term | Long-term (usually 99-year), renewable lease | Short-term or month-to-month lease |

| Equity | Owner builds equity and earns a share of appreciation | Little to no equity; depreciation is common |

| Resale Rights | Owner can sell with restrictions to maintain affordability | Must often move home or get park approval to sell |

| Stability | Legal protections in lease; stable housing model | Leases can be raised or terminated at owner’s discretion |

| Community Focus | Mission-driven, nonprofit governance | For-profit; less resident control |

Who can Qualify for a CLT Home?

CLTs are typically geared toward low- to moderate-income households, but the exact income limits and qualifications depend on the organization and funding sources.

Basic qualifications often include:

Household income within a certain percentage of Area Median Income (AMI)—commonly 60% to 120%

Commitment to owner-occupy the home (not use as a rental)

Demonstrated need (e.g., cost-burdened renter, first-time buyer)

Ability to qualify for a mortgage (more on that below)

What’s the Process Like?

Each CLT may have slight variations, but here’s a general outline of what to expect:

1. Application

Submit an application with household and income documentation.

Attend an orientation or info session hosted by the CLT.

2. Pre-Qualification

Get pre-approved by a mortgage lender that’s familiar with CLT guidelines.

Some CLTs have partnerships with specific lenders; others may allow buyer choice.

3. Homebuyer Education

Most CLTs require you to complete a HUD-approved homebuyer education course, which prepares you for long-term ownership responsibilities.

4. Property Match

Once approved, you’ll be shown available CLT homes and can select one that meets your needs.

5. Closing

The transaction works like a traditional real estate closing, with the CLT involved in the process.

You’ll close on the home (not the land) and sign the ground lease with the CLT.

Do I need a Special Lender?

Some CLTs partner with approved lenders who understand the ground lease structure and underwriting process. However, depending on the CLT, you may be able to use any lender as long as:

The lender agrees to the CLT’s lease and resale restrictions

The underwriter is comfortable with non-traditional land ownership

Tip: Local credit unions and community banks are often more familiar with these programs than national lenders.

What About Down Payments?

One of the biggest advantages of buying through a CLT is a significantly lower down payment. Because the land is owned by the nonprofit trust, the purchase price is typically much lower than comparable homes on the open market. Most buyers only need to bring 3% to 5% down, and some qualify for down payment assistance or low-interest programs through city, county, or lender partnerships.

This makes CLT homes especially attractive for first-time buyers or those with limited savings—but strong, steady income.

What Might Disqualify a Buyer?

While the process is designed to be inclusive, some factors that might limit eligibility include:

Income above the program limit

Poor credit or inability to secure financing

Intent to use the home as a rental or investment

History of foreclosure or eviction (varies by CLT)

Incomplete documentation or failure to complete homebuyer education

Every CLT is a little different—some may be more flexible than others, especially if funding comes from local sources rather than federal HUD programs.

What are the Pros and Cons?

What Are the Pros and Cons?

Pros:

Significantly lower purchase price

Long-term housing stability

Builds equity (though limited)

Protection from rising land costs and speculation

Community-based governance and support

Cons:

Limits on resale price = less profit when selling

Resale process must go through CLT

May not qualify for all loan types

Not available in every area or for every buyer

Buying through a Community Land Trust is a powerful path to affordable homeownership—but it’s not always easy to navigate alone. From understanding eligibility to working with the right lender and submitting a strong application, every step matters. As a licensed Florida agent who actively tracks these opportunities, I can help you find the right program, understand the fine print, and move forward with confidence.

Reach out today to explore your options—or just to ask questions. I’m here to help you take the next step toward ownership, without the guesswork.

Aging Homes, Serious Risks: Understanding Asbestos and Other Hazards in the Gulf States

Photo by Alex Boyd

Homes built before the 1980s often carry more than architectural character—they may harbor serious health risks tied to outdated construction practices. Warm, humid climates can accelerate material deterioration and create conditions for mold, asbestos exposure, and other issues. Organizations such as Louisiana Mesothelioma Advocates play a critical role in spreading awareness and offering support. Their mission centers on educating families affected by mesothelioma, equipping them with resources to make informed decisions about treatment options, physicians, legal considerations, and other concerns that may arise during such a difficult time. In states like Louisiana and Florida, where aging homes and historical industries increase the risk of asbestos exposure, these efforts remain vital in protecting public health and guiding those impacted by these long-term hazards.

Why Older Homes Pose Health Hazards

In the decades before strict federal safety regulations were implemented, materials now known to be dangerous were widely used. Among them, asbestos-containing materials (ACMs) were common in insulation, roofing felt, vinyl flooring, cement, and “popcorn” ceilings. Valued at the time for their durability and fire resistance, these materials have since been linked to serious health issues, particularly when disturbed through renovations, storm damage, or the natural aging of the home.

Friable asbestos—materials that crumble easily and release fibers into the air—pose the greatest risk. Once inhaled, these fibers can lodge in lung tissue and lead to conditions such as mesothelioma, lung cancer, or asbestosis. The risk is especially relevant in homes that have not undergone professional asbestos remediation or testing.

Louisiana's Unique Exposure Profile

Louisiana’s industrial background—particularly in oil refineries, shipyards, and chemical plants—has made the state one of the nation’s hotspots for asbestos-related illnesses. The widespread historical use of asbestos in both residential and industrial structures, combined with the destruction caused by hurricanes like Katrina, has led to prolonged airborne exposure for thousands of residents and emergency responders.

Florida’s Older Housing Stock and Compliance Gaps

Florida, known for its rapid population growth, has many homes constructed during periods when safety oversight was limited. Although lead-based paint was banned in 1978, it remains in older properties, especially in plumbing and interior finishes. Lead exposure is linked to neurological and developmental issues, especially in children. Disclosure is required under federal law, but many homes still pose hidden risks if not professionally evaluated.

Mold is another common issue. It can develop in drywall, wallpaper, carpets, ceiling tiles, and anywhere with persistent moisture. In states like Florida and Louisiana, where humidity is high and storm damage is frequent, mold growth is especially problematic. Even newer homes can develop mold if leaks or ventilation issues are present.

Precautionary Measures for Prospective Buyers

Individuals considering homes built before 1980 should:

Schedule an asbestos inspection prior to initiating any renovations or DIY projects.

Confirm that any lead-based paint disclosures are reviewed.

Seek mold evaluations, especially in homes with prior water damage or signs of high humidity.

Work with real estate agents familiar with the risks and required disclosures in older homes.

Staying informed and proactive is essential. For additional guidance, review materials offered by reputable health organizations or legal advocacy groups specializing in environmental hazards and housing safety.

For those exploring homeownership in Florida or Louisiana, especially with an eye on charming older properties, professional assessments are critical. Connect with local agents and inspectors who understand the unique risks associated with the region’s housing stock and can guide the process safely and confidently.

Buying an older home in Florida? Let’s make sure it’s as safe as it is beautiful. Contact me for trusted local inspectors and real estate guidance that protects your investment—and your health.

Why Florida’s Booming Economy Makes Now the Perfect Time to Buy Real Estate

Photo by Bridger Bowcutt

Florida has recently been recognized as having the strongest economy in the United States, according to a comprehensive ranking that evaluates states based on multiple factors including health care, education, environment, opportunity, crime and corrections, infrastructure, fiscal stability, and economic strength. Climbing three places from the previous year, Florida now stands as the sixth-best state overall in this national assessment.

This remarkable achievement reflects Florida’s rapid economic growth fueled by a diverse range of industries. Tourism remains a cornerstone of the state’s economy, attracting millions annually to its world-renowned beaches, Orlando’s major theme parks, and bustling cruise ports on both the Atlantic and Gulf coasts. Beyond tourism, Florida’s agriculture sector is a vital contributor, with its citrus groves and year-round vegetable production playing a significant role in the state’s economic output.

Florida’s business-friendly environment is also bolstered by the absence of a personal income tax, a factor that continues to draw retirees, entrepreneurs, and investors alike. This, combined with strong educational rankings—where Florida ranks second nationally—makes the state an attractive place to live, work, and invest.

Among southern states, Florida is unique in its consistent top-10 standing, joining other leading states across the country that are recognized for their balanced approach to economic opportunity, quality of life, and fiscal responsibility. This upward momentum indicates that Florida is not only a premier destination for residents and businesses but also a state poised for sustained growth and development.

If you’re considering making a move or investing in Florida’s thriving real estate market, now is the perfect time. With opportunities ranging from vibrant urban neighborhoods to peaceful waterfront communities, I’m here to help you find the ideal property that fits your lifestyle and goals. Contact me today to explore the best that Florida has to offer!

HOME INSPECTIONS

BUYER SIDE / SELLER SIDE

A home inspection is a professional, objective assessment of a property's physical structure and major systems. It's a vital step in the home buying process, helping to uncover potential issues before closing, so buyers can make informed decisions.

As the buyer, you have the right to choose your own home inspection company. You're not required to use one recommended by the agent or seller—feel free to select a licensed inspector you trust to thoroughly evaluate the property and protect your interests.

Once the inspection and payment is made, you'll receive access to your personalized buyer portal, where you can view your inspection report, photos, and any recommended next steps

INSPECTION “ADD-ONs”

A 4-point inspection is often required by insurance companies in Florida, especially for homes over 20 years old. It focuses specifically on the roof, electrical, plumbing, and HVAC systems to determine insurability. While it's not part of a standard home inspection, it can usually be added on during the same visit and is essential for securing homeowners insurance.

For a cash buyer, a 4-point inspection is not required, since there's no lender or insurer mandating it—unless the buyer still plans to get homeowners insurance.

A wind mitigation inspection evaluates how well a home can withstand strong winds and hurricanes—a key factor in Florida insurance costs. It looks at roof shape, coverings, attachments, and protection for openings like windows and doors. This report can often qualify buyers for valuable insurance discounts.

A well inspection checks the condition and safety of a property's private well system, including the pump, pressure tank, and water quality. It ensures the water is safe for use and that the system is functioning properly—an important step for homes not connected to municipal water.

A septic tank inspection evaluates the condition and functionality of a home's private wastewater system. It includes checking the tank, drain field, and related components to ensure proper operation and identify any signs of leaks, backups, or needed maintenance—crucial for homes not connected to public sewer lines.

A water test analyzes the quality and safety of a home's water supply, checking for contaminants like bacteria, lead, nitrates, and other pollutants. This is especially important for properties with a well, ensuring the water is safe for drinking, cooking, and daily use.

A termite inspection checks for signs of active or past termite activity, as well as other wood-destroying organisms that can damage a home's structure. It’s a vital step in protecting your investment, especially in Florida’s warm, humid climate where termites are common.

Real estate agents play a crucial role in recommending home inspections and helping clients understand the results. They guide buyers and sellers through the implications of the findings, advise on necessary repairs, and help protect both the property's value and the client's interests.

For sellers, a pre-listing home inspection gives sellers valuable insight into their property's condition. By identifying and addressing issues early, sellers can increase market value, build buyer confidence, and help ensure a smoother, faster sale.

Sample section of inspection results:

Once the home inspection report is in hand, it can feel overwhelming for buyers—especially first-timers. That’s where a knowledgeable real estate agent steps in. As your advocate, a Realtor doesn’t just review the report; they help you interpret it strategically.

Not every item on an inspection report is worth negotiating over. Your agent will help you identify which issues are safety concerns, code violations, or major system failures—and which ones are cosmetic or expected for the home’s age. From there, your agent will work with you to draft a clear, reasonable repair request or ask for seller concessions if appropriate.

This negotiation process requires a balance of firmness and finesse. An experienced agent knows how to present your request professionally, keeping the deal moving forward while protecting your best interests.

PRE-LISTING INSPECTION

Sellers benefit from home inspections by gaining transparency about their property's condition. Pre-inspection enables sellers to address issues ahead of time, enhancing market value and speeding up the sale.

Top 10 Things Sellers Should do to Prepare for an Inspection:

Change the AC filter and clean vents. A dirty filter or dusty vents suggests poor maintenance. A fresh filter and clean ducts show the HVAC system is being properly cared for.

Check for plumbing leaks. Inspect under sinks, around toilets, and behind appliances for any signs of leaks or water damage. Fix drips, loos connections, and water stains.

Test all smoke and carbon monoxide detectors. Replace batteries and ensure all detectors are property installed and working.

4. Service the HVAC system. Have the AC and heating system serviced by a licensed technician if it hasn’t been done in the past year. Leave documentation of the service for the inspector.

5. Ensure all lights, outlets and fixtures work. Replace any burnt-out bulbs, and test each outlet. This avoids the assumption that electrical work may faulty.

6. Clean gutters and dowspouts. Clear out debris and ensure water is draining away from the foundation properly.

7. Repair minor wall and ceiling cracks or nail pops. There are often cosmetic but can be misinterpreted as foundation or structural issues.

8. Check doors and windows for proper operation. Make sure they open, close and lock properly. Fix any sticking, squeaking, or loose hardware.

9. Seal gaps around windows for proper operation. Prevent drafts, moisture intrusion and pest access. Use caulking or weaither stripping where needed.

10. Label the electrical panel and ensure clear access. Inspectors need to see the panel clearly labeled and unobstructed. Replace any missing covers or breakers if needed.

“THANK YOU!”

Hazards in pre-1990 Homes

Hazards to watch out for in homes built before 1990.

Photo by Michael & Diane Weidner on Unsplash

Governments and regulatory bodies establish and enforce new safety regulations and standards across industries every year. Construction companies, specifically home builders, have seen several compliance requirements be established in the last thirty years. However, the homes built before those mandates were in place can pose significant health risks for their owners.

Here are dangers to watch out for when buying older properties:

Lead

Government banned the consumer use of lead-based paint in 1978. It can be found in plumbing fixtures and paint, and can affect brain development in children, as well as cause headaches and abdominal pain. Sellers must disclose the presence of lead-based paint in the home.

Asbestos

Exposure to asbestos can cause cancer and mesothelioma. It was commonly used in insulation, sheathing, vinyl floors, “popcorn” ceilings and roofing felt. The EPA issued a ban in 1989 on most of these products. Consult a professional to analyze samples, and plan accordingly depending on the results. Exposure is riskiest when fibers are damaged and can become airborne.

Mold

Mold can present itself in homes of any kind, new and old. Homes that lack ventilation or that have been affected by water damage in the past are at most risk. It can grow in windows or pipes, drywall, carpet, ceiling tiles and wallpaper. It can cause itchy eyes and skin rashes. Sometimes insurance companies may cover remediation, specially if the mold was caused by a leak.

Always remember to consult your real estate agent about the presence of these hazards in older homes.

The new Lead of Luxury Markets: Millennials

There’s been a new and significant shift in the luxury real estate market: Millennials are now responsible for nearly 60 percent of purchases for homes 3 million dollars and above, according to a new report by Engel & Völkers, a multinational real estate firm. This change has seen those born between 1981 and 1996 take the top spot from baby boomers (born from 1946 to 1964). Most of these luxury millennials are buying their second home and prefer locations near recreational attractions, like bars, restaurants, theaters, spas and gyms. They also prefer neighborhoods with amenities, including pools, dog parks and children’s playgrounds. Although baby boomers will continue to influence the economy, they are now empowering the younger generations, like Millennials and Gen-Xers, with the financial means to lead the future of the luxury segment of real estate.

It comes without question that many will wonder how, exactly, these many Millennials are able to afford 3+ million dollar properties. Talking with several real estate agents in my network, the question mostly traced back to the same answer: inheritance. The wealth left behind by the decreasing population of Baby Boomers is without a doubt being inherited by their children and grandchildren, one agent said. “Many of them [baby boomers'] own large acres of land, which has seen exponential price increases not only in the last four years, but in the last fifty.” An interesting study would thereby look into this observation to ascertain whether this is the case. It’s no secret that Millennials are not seeing the same economic growth previous generations did. A Bloomberg article from 2021 reported that 40 year old Millennials at the time were only 80 percent as wealthy as their parents at the same age. “Millennials in the U.S. at 40 are doing worse financially than the generations that came before them,” the article stated. “Fewer millennials own homes than their parents did at their age. They have more debt — especially student debt. They simply aren’t as wealthy.” So there’s more to this shift than the Engel & Völkers report is able to look into. Nonetheless, real estate agents need to adapt to this new shift and tackle the opportunities it presents.

A Walk Through Kissimmee Bay

In this video Daniel Araque walks us through the great attractions of the Kissimmee Bay community. This upscale and well-established enclave features direct access to lake Toho, and an eighteen-hole championship golf course.

Casa Finca for Sale in Medellín

Para más información no dude en escribirnos / For more information don’t hesitate to contact us.

5.5% Interest and What it Means

Before starting my day each morning I open my Mortgage News Daily app and check the current interest rate for thirty-year fixed loans. Changes in inflation and the volatility of nearly all markets in the last sixteen months forced the Federal Reserve to introduce robust policy changes, which recently impacted homebuyers more intensely. These interest changes have been almost as volatile as the global markets themselves, oscillating between 5.2 percent at the end of May, to 6.28 percent the fourteenth of June, and now sitting comfortably at 5.5 percent as of this morning. Many homebuyers expected, somewhat correctly, the increased rates to curve the real estate climate from the competitive (and mostly toxic) seller’s market of the last two years to a more accessible buyer’s market, where bidding wars and appraisal gaps would no longer be the norm. And although this has been the case to some extent, we’re still seeing the most attractive listings receive upwards of five offers and sellers still unwilling to budge in any of their strict, irrational demands. So what have the rate changes truly achieved, and will there be a plummet of home prices in the future?

“We’re going to wait a few months before looking again,” one of my clients said to me recently. “Homes are still too expensive and we think they’ll drop to normal levels again.” In my years as a real estate agent I've learned to pick my battles. My number one job is to protect my client’s interests, whether they're buyers or sellers, and get them the best deal while traversing the often thorny path towards closing. So when a client makes a decision more akin to a personal life choice, I step back and allow them that right. (Many agents will roll their eyes at this, proclaiming we are salesmen and must sell at all costs.) But I'm tempted to ask, what are normal levels? If the annual inflation rate in the United States in 2021 was seven percent, why would you think this will get reversed out of thin air? Inflation devalues money, and it’s reflected in higher prices everywhere. We must also account for out-of-state buyers, mainly from New York and California, who think the current home prices in Florida, while high for locals, are a steal in comparison. They're buying cash and over-purchase price, waiving inspections and appraisals, setting new home values for entire neighborhoods while doing so.

Although the Federal Reserve’s policy changes caused a slight leveling of home prices, we’ve observed a sharper decline in the number of overall qualified buyers. Those who qualified for a 500 thousand dollar home three months ago suddenly have to be more mindful about their budget. Several agents have seen their deals go sour as their clients couldn't get a reasonable rate locked in — reminding buyers that a pre-approval is only a snapshot in time of their financing potential, always at the mercy of any national and global trends. And while some continue to wait for a better time to buy, companies like Disney are taking advantage of new developments and setting up regional hubs that will change the average income per capita of the area by relocating workers from California. “I saw two-bedroom apartments they’e planning to rent for thirty-five hundred dollars,” said one my coworkers about a neighborhood in Lake Nona. “To us it’s crazy but to people from that state it’s normal, or even cheap.” If the average wage for these Disney employees is 120 thousand dollars annually, according to the Orlando Economic Partnership, they can easily buy any home in Lake Nona and Orlando — why would home prices drop?

There’s one way I see home values declining a considerate amount — a way that supersedes inflation, appraisals and the solidified market value of sold homes, and the price influence from out of state money: global economic collapse. Consumer-spending data is fueling worries about a recession. Gas continues to break record highs. Russia is unrelenting in its attack on Ukraine. China waits. If something happens at a global scale all markets will take a hit, but, for now, expecting that 400 thousand dollar home to go back to 280 is a dream better left in the past.

Thoughts From Realtors: The Current Market

“We received 29 offers on this property and after sorting through all of them the sellers have decided to accept a different offer.”

Home buyers across the United States who are trying to take advantage of record low mortgage rates are often met with the bad news that the home was sold to someone else. Low inventory and an onslaught of new buyers gave rise to the current sellers’ market, which, from the books of ECON 101, means prices are going up, up, up. I'm not looking to explain what’s happening, as many other articles, YouTube videos and think-pieces have done so already, but, rather, I want to discuss what could be coming next. Despite the number of active buyers making this market as competitive as it is, there’s another set of qualified buyers who’ve chosen not to buy, yet. “I think there’s a crash coming,” said one of my out-of-state clients last week. “There’s something weird going on — I don't know what, exactly, so I rather wait and see what happens.” This is a fair and increasingly common assessment of the current situation — after a year of lockdowns and massive unemployment caused by COVID-19, why is everyone suddenly able to buy a home? Buyers, sellers, realtors, and everyone else are asking themselves this same question, ultimately leading to the mother of all questions: what’s the future of this market? I presented this and other questions to two of my coworkers during our last work meeting to get a quick answer for an otherwise difficult situation to evaluate.

Is this a good time to buy?

Cristian: This is still a good time to buy because of the low interest rates but I think this will be be short lived and the market will normalize itself in the next 24 months.

Juliette: It depends whose perspective you’re looking at it from. If I sell my house in another state and move to Florida I’m looking at a better lifestyle. So for them it’s probably a good time; If you’re moving from somewhere else in Florida, I would say wait.

What will the market look like afterwards?

Juliette: I’m not 100% sure but the way it’s looking referencing specs from last year versus this year I project a continual increase.

Cristian: In the next 12-24 months we will see the interest rates start to go up and prices going down and we will welcome a buyers market.

As expected, my coworkers thoughts were somewhat split through the middle. What the Orlando market (and perhaps others around the United States) will look like a year from now is a question no one has the answer to. But like the saying goes, there are two types of people in this world… those who think the market will crash, and those who think homes will retain their value or even go up more over time. A crash — or correction — is easy to explain and imagine, but a continual increase in home value is a scenario that also enjoys a set of circumstances that back it up.

It’s no surprise that the influx of new buyers to Orlando are coming mostly from states like California and New York. Those from the latter used to come in search of better weather; now they're escaping failed policies that left their economy in shambles. And it’s not only people who are leaving — large companies are relocating to friendlier states, like Tesla’s recent move to Texas. As companies and people move, their money moves with them. And as that money gets invested into real estate, you start to see the value of the market change. “What decides the value of a home is the market, nothing else,” my broker reminded the team in our last meeting. “If a home in a specific neighborhood sells at a record high, every other home in that neighborhood benefits from it.” So the new money from other states making its way into Orlando is inadvertently reflected in home prices all over, as we’re seeing lately. And those with the buying power to pay a premium price for a home are squeezing out those first-time homebuyers who were hoping to buy a piece of America. This is what eventually leads us to those 29 offers for a single home, only one lucky winner, and 28 sad real estate agents pouring themselves another drink.

“People are saying Orlando is the new L.A.,” a coworker said as we neared the end of the meeting. If this is the case then what we’re seeing now, despite the rate of change in home values over the last year, can still be considered homes for cheap. Otherwise it’s nothing more than a frenzy. Truth is, many things can influence the market, and at the end of the day buyers and sellers have to decide for themselves whether it makes sense for their family to buy or sell. Decisions should be made according to specific goals beyond the current monetary value of a home, and whether a correction or further spike is something said family can live with or afford.

For any real estate related questions don’t hesitate to call or write to us. We’ll be happy to help!

Understanding Closing Costs

Photo by Gabrielle Henderson

One of the main obstacles buyers often seem to overlook are the costs associated with the purchase of a new home. Naturally, a buyer’s main concern — beyond securing financing — is simplified to finding the perfect home. But before that home’s title gets transferred to the new owner, there are closing costs that both seller and buyer need to pay. Some of these are shared and split “down the middle,” like prorated property taxes and HOA dues, but others are specific only to the seller and the buyer. In real estate this is simply known as “cash to close,” and, for buyers, it could be anywhere between three to five percent of the purchase price of the home. However, in order to obtain the most accurate estimate, a real estate agent can share the information of a specific home with the buyer’s lender, who will thereby calculate what the final costs could look like.

The simplest way to understand closing costs is to think about the parties associated with the sale of a home. These costs, then, are broken down between fees from the state, fees from the title company and lender, and fees to the realtor. (As a buyer, your real estate agent is “free” to you. There’s only one small brokerage fee paid to their company.) Each of these parties costs are reflected as a percentage of the purchase price or a set amount per transaction. There could be small variations depending on the title company or lender, and whether you’re a cash buyer, or are using a conventional or FHA loan. The list below shows and explains some of the costs you’re likely to see in your final settlement statement.

Closing Costs

Origination Fee

Payment to lender to evaluate your credit, and to underwrite and process loan.

Discount Points

Paid to lender at closing to reduce interest rate over life of mortgage.

PMI or Mortgage Insurance (Conventional Loan)

Required if down payment is less than 20%. Protects lender if you default.

Appraisal Fee

Paid to appraiser to confirm home’s fair market value.

Title Search

Covers cost to confirm seller owns property, and that title is free from liens.

Title Insurance

Protects lender and (optionally) you if title claim surfaces later.

Termite Inspection Fee (Free for VA loans)

Inspection required to certify home is free of termite damage.

Survey Fee

Charge to verify property boundaries.

Buyer Trans-Fee

Paid to cooperating buyer’s agent brokerage.

Flood Certification Fee

Covers costs to determine if home is in federally designated flood zone. If it is, lender will require you to purchase flood insurance. Some lenders also charge separate flood monitoring fee to check for flood map updates.

Prepaid Interest

Covers mortgage interest due between date of closing and first mortgage payment.

Prorated Property Tax

Covers property taxes from date of closing to end of tax year.

Homeowner’s Insurance

Typically you'll pay full first-year costs upfront at closing.

Homeowner’s Association Transfer Fee

Paid on properties governed by associations to transfer ownership documents to you.

Initial Escrow

Lender may require first two months of next year’s homeowner’s insurance, flood insurance and property taxes to build up reserve.

Closing or Settlement Fee

Paid to title company, attorney or escrow company that conducts closing.

Recording Fee

Paid to state to record transfer of property from one owner to another.

Transfer Tax

Paid to state, based on the amount of the mortgage.